Survey Shows Small Businesses’ Growing Concern about Raising Capital

Small business owners’ perceptions of their access to capital have declined over the last five years according to the latest MetLife and U.S. Chamber Small Business Index.

About half (49%) of small business owners surveyed say their current access to capital or loans is good. That is slightly lower than in Q2 2022 (54%), and significantly lower than those who said their access was good in Q2 2017 (67%).

The data also shows that compared to a year ago, more small business owners are turning to personal savings to fund their businesses.

Savings Are Top Way to Fund Small Businesses

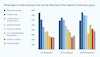

A majority of small businesses rely on their personal savings (69%) for capital/loans to fund their business. Credit cards and using local banks or credit unions are also top sources of financing for small business owners.

More small businesses now (69%) say they rely on personal savings to finance their business compared to Q2 2022 (60%) and Q1 2020 (43%).

Demographics also play a role in relying on personal savings to fund a small business. Three in four (74%) female-owned businesses say they have turned to personal savings, compared to 66% for male-owned businesses.

The survey also found that businesses with 0-4 employees are more likely to use personal savings to finance their business compared to small businesses with 20-500 employees.

Both men and women-owned small businesses say they are relying on personal savings more now than in Q2 2022 to finance their businesses.

Male-owned businesses are more likely to report having gone to national banks (48% vs. 33% for female-owned) for financing and are more likely to say their access to capital or loans is good (52% vs. 43% for female-owned).

Barriers to Securing Small Business Financing

Small businesses owners cite various barriers to securing financing for their business including:

- A time-consuming application process (52%)

- Not having enough information on available sources of capital (46%) and

- Not having enough revenue or assets to qualify for a loan (46%).

Larger small businesses report better access to capital. Nearly three in four (73%) small businesses with 20-500 employees say they have good access to capital, compared to 55% of those with 5-19 employees, and 41% of those with fewer than five employees.

The data on access to capital comes as just one in five (20%) small business owners surveyed saying they believe the U.S. economy is in good health, falling from 27% saying the same last quarter.

The Index’ overall score dropped slightly to 60 from 62.1 in Q4 as small business owners’ outlook on the national economy weakened.

The Q1 2023 SBI survey was conducted between January 16-Februrary 2, 2023. For more findings from this quarter, and to explore and browse years of small business data, visit: https://www.uschamber.com/sbindex/.